I PLUS del MASTER

-

25Anni di esperienza

-

+500Edizioni Master

-

150Matching con le aziende

-

300Docenti professionisti

-

+90%Placement & Stage

-

25Anni di esperienza

-

+500Edizioni Master

-

150Matching con le aziende

-

300Docenti professionisti

-

+90%Placement & Stage

ACCREDITED MASTER'S COURSES - ISSUE OF TRAINING CREDITS

The Italian Chartered Accountants National Council (“CNDCEC”), having received the favourable opinion of the Ministry of Justice, has approved the inclusion of MELIUSFORM Business School in the list of Associations entered in the Register and of other subjects authorised to organise “continuing vocational training” (CVT), established pursuant to art. 11, para. 1, of the CVT Regulation. MELIUSFORM is thus authorised to organise classroom training activities at a national level for the benefit of members entered in the Register of Chartered Accountants. This authorisation is valid until 31 December 2025 (unless revoked), marking the conclusion of the current three-year training period.

The Italian Chartered Accountants National Council (“CNDCEC”), having received the favourable opinion of the Ministry of Justice, has approved the inclusion of MELIUSFORM Business School in the list of Associations entered in the Register and of other subjects authorised to organise “continuing vocational training” (CVT), established pursuant to art. 11, para. 1, of the CVT Regulation. MELIUSFORM is thus authorised to organise classroom training activities at a national level for the benefit of members entered in the Register of Chartered Accountants. This authorisation is valid until 31 December 2025 (unless revoked), marking the conclusion of the current three-year training period.

Attendance of the Executive Master In Corporate Finance & Controlling entitles the student to receive the following Training Credits, since the following training modules/courses forming part of the Master's programme have been accredited (one credit for each hour of training provided):

- Module/Course “Financial Statements as an information and control tool”: 48 training credits

- Module/Course “Business Planning & Financial Modelling: from the Business Plan to the assessment of investment projects”: 16 training credits

- Module/Course “Corporate Treasury and Treasury Management”: 16 training receivables

- Module/Course “Financial Due Diligence”: 16 training credits

- Module/Course: “Extraordinary financial transactions and Distressed M&A”: 8 training credits

- Module/Course “Management Control and Programming Systems”: 40 training credits

ACCREDITED MASTER'S COURSES - ISSUE OF TRAINING CREDITS

The Italian Chartered Accountants National Council (“CNDCEC”), having received the favourable opinion of the Ministry of Justice, has approved the inclusion of MELIUSFORM Business School in the list of Associations entered in the Register and of other subjects authorised to organise “continuing vocational training” (CVT), established pursuant to art. 11, para. 1, of the CVT Regulation. MELIUSFORM is thus authorised to organise classroom training activities at a national level for the benefit of members entered in the Register of Chartered Accountants. This authorisation is valid until 31 December 2025 (unless revoked), marking the conclusion of the current three-year training period.

The Italian Chartered Accountants National Council (“CNDCEC”), having received the favourable opinion of the Ministry of Justice, has approved the inclusion of MELIUSFORM Business School in the list of Associations entered in the Register and of other subjects authorised to organise “continuing vocational training” (CVT), established pursuant to art. 11, para. 1, of the CVT Regulation. MELIUSFORM is thus authorised to organise classroom training activities at a national level for the benefit of members entered in the Register of Chartered Accountants. This authorisation is valid until 31 December 2025 (unless revoked), marking the conclusion of the current three-year training period.

Attendance of the Executive Master In Corporate Finance & Controlling entitles the student to receive the following Training Credits, since the following training modules/courses forming part of the Master's programme have been accredited (one credit for each hour of training provided):

- Module/Course “Financial Statements as an information and control tool”: 48 training credits

- Module/Course “Business Planning & Financial Modelling: from the Business Plan to the assessment of investment projects”: 16 training credits

- Module/Course “Corporate Treasury and Treasury Management”: 16 training receivables

- Module/Course “Financial Due Diligence”: 16 training credits

- Module/Course: “Extraordinary financial transactions and Distressed M&A”: 8 training credits

- Module/Course “Management Control and Programming Systems”: 40 training credits

Applicativi EXCEL® Gratuiti

Applicativi EXCEL® Gratuiti

-

Un foglio di lavoro che racchiude i principali schemi di riclassificazione del bilancio, indici e di rendicontazioni per l'analisi economica e finanziaria

-

Dallo schema civilistico allo schema gestionale

-

Un foglio di lavoro con tutti i piani economici, finanziari e patrimoniali previsionali e gli indici di proiezione

-

Dallo schema civilistico allo schema costi fissi/variabili

-

Un foglio di lavoro con il piano di tesoreria suddiviso per livelli di informazione (entrate, uscite, saldi, ecc.) e il quadro sintetico dei flussi

-

Dallo schema civilistico allo schema per aree funzionali

-

Calcolo del Break Even Point per quantità e fatturato

-

Dallo schema civilistico allo schema per incremento di valore

-

Verifica dei tempi di incasso e pagamento sulle fatture di vendita e di acquisto

-

Dallo schema civilistico allo schema della contrapposizione fra costi e ricavi

-

Verifica dei tempi di stoccaggio dei beni produttivi e delle merci

-

Schema di bilancio ex d. lgs. 117/2017 pubblicato in G.U. n. 102 del 18 aprile 2020

-

Dallo schema civilistico allo schema del Liquid First

-

Schema di bilancio ex d. lgs. 117/2017 pubblicato in G.U. n. 102 del 18 aprile 2020

-

L’applicativo calcola il valore dell’azienda utilizzando il metodo patrimoniale (patrimonio netto rettificato).

-

Applicazione per il calcolo dell'IVA

| Partnership & Certification | |

|

|

Enter your login details (Username and Password) in the URL address line you will be given before the lesson

Enter your login details (Username and Password) in the URL address line you will be given before the lesson Thanks to its innovative training scheme Meliusform Business School received the AIF Adriano Olivetti Award as 1st ranked in the training section of the Administration & Finance area.

Thanks to its innovative training scheme Meliusform Business School received the AIF Adriano Olivetti Award as 1st ranked in the training section of the Administration & Finance area.

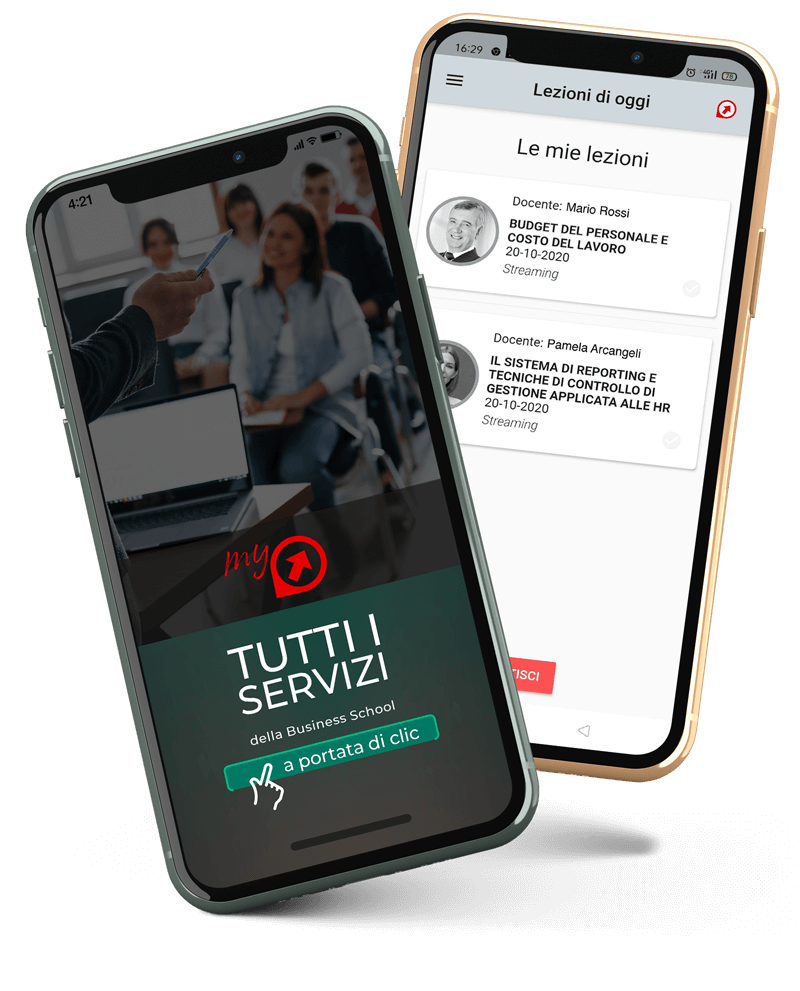

È arrivata nell’App store e Google play la nuova App MY MELIUSform.

È arrivata nell’App store e Google play la nuova App MY MELIUSform.